How it works

Getting invoice insurance can be a lengthy process. We make it easy for dynamic companies like yours to take advantage of this type of insurance and protect themselves. Our service is totally free to use, and we may get commission when you take a policy out. This won’t increase the price of your premium.

Start a quote today in minutes.

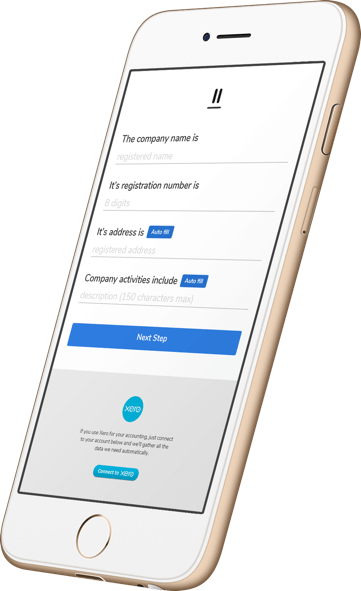

Just provide us with a few details about your company. Tell us about your clients and where they are. Then our advanced matching function will connect you with selected brokers and insurers in our network to meet your specific needs.

Smaller companies may be connected with our specialist provider of single invoice insurance.